The IRS announced on Monday, May 17th that approximately 39 million American families will be eligible for monthly payments of up to $300, thanks to the newly expanded child tax credit that will start on July 15.

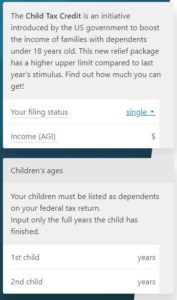

Eligible families qualify for up to $300 per month for each child younger than 6 and up to $250 for each child aged 6 to 17. Payments will be automatically deposited into accounts on file with the IRS. (Your children must be listed as dependents on your federal tax return.)

Deposits will be made from July through December, 2021. The payments that represent the first half of 2020 will be provided later in a lump sum.

Want to learn more, and find out how much you will receive? Use this Child Tax Credit Calculator by Omni Calculator to learn more.

Have questions about how this Child Tax Credit will affect you and your family? Contact our Tax Services Department to learn more – info@lifetimetaxmanagement.com.