Presented by Matt Glova and the team at LifeTime Asset Management

With the third wave of infections accelerating around the country, the medical news continues to get worse. Case growth has reached new highs, and the geographic spread of this wave continues to deepen. In fact, case growth in many states remains at levels that threaten health care systems, and several states have moved back to lockdown mode.

While the medical risks increase, the economic recovery is still moving forward. Last week’s jobs report showed continued job growth, and the unemployment rate dropped significantly as private payroll growth was particularly strong. Consumer confidence ticked up, although spending (an area of concern) may be showing signs of weakness. Business confidence and investment also posted strong results. With the continued economic progress, on top of the reduction in political and policy risks from the results of the election, financial markets have rallied. Let’s take a look at the details.

The Virus: New Cases Still on the Rise

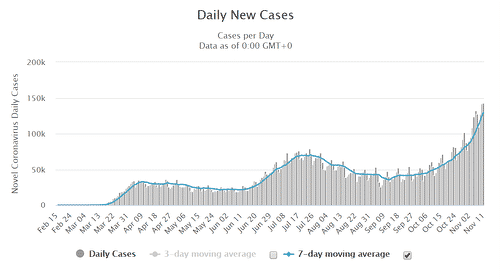

New cases per day. The most obvious metric for tracking the virus is daily new cases. Here, we see that widening state-level outbreaks have continued to increase viral spread, to the point we again see new highs, at almost 143,000. The seven-day average number of new cases per day is now up to almost 130,000, up from 93,000 a week ago, again a faster increase than the previous week. This is the eighth week in a row we have seen an increase, and the rate of increase has grown every week. This increase, combined with the wider geographic spread, means case counts are likely to keep rising over the next several weeks. The third wave is now significantly more severe and looks likely to be much longer lasting than prior waves. There are no signs yet that the growth rate is slowing.

Source: https://www.worldometers.info/coronavirus/country/us/

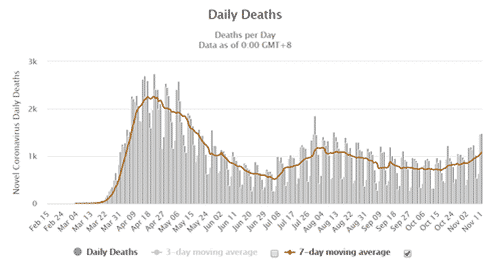

Death rate. The death rate also continues to rise. This is a lagging indicator and runs 6–8 weeks behind case growth. As such, recent increases in the death rate reflect faster infection growth in late September. On a seven-day moving average basis, daily deaths were at 1,080 as of November 11, up from 894 in the prior week. As the number of new cases has spiked since late September, we can reasonably expect death rates to increase substantially as well over the coming weeks.

Source: https://www.worldometers.info/coronavirus/country/us/

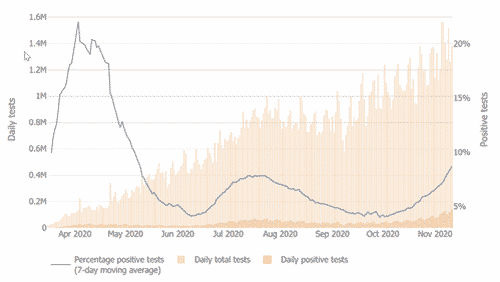

Testing data. Finally, the testing news also got worse. The number of tests has peaked for the moment, although it remains quite variable. The positive testing rate also continues to rise further above the recommended maximum of 5 percent, showing that the pace of increasing infections is once again outrunning testing capacity. While some of the increase in cases may come from better visibility from increased testing, the rising positive rate suggests the growth in cases is more likely due to a widening range of infection growth. This idea is supported by the fact that, in several states, the positive rate is now well over 20 percent.

Source: Johns Hopkins University

The bottom line is that, on the medical front, the trends are still moving in the wrong direction, at an increasing rate, and a third wave continues to spread. More than 20 states are now seeing the fastest spread of the pandemic thus far, essentially the same as last week. In several of those states, there are outbreak hotspots that are now becoming health emergencies. Even in states where the virus remains under control, spread rates are also rising.

Looking forward, the question is whether the situation will continue to get worse. Given the ongoing accelerating infection rates and the fact that many outbreaks are in rural areas with limited local health care resources, that outcome looks likely. Further, with rising positive test results around the country and with the lags between infection and detection, we are likely to have weeks or more to go before the full effects will be seen. That said, several states are now implementing policy measures to limit viral spread over time, which should help. Overall, however, the medical risks are likely to keep rising over coming weeks, as the third wave runs its course.

The Economy: Recovery Carries On

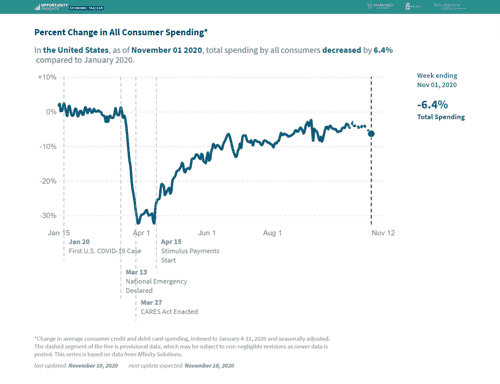

Consumer economy. While the medical situation is deteriorating, the economic recovery continues, despite mixed data. The job market has been better in the past couple of weeks, with the most recent jobs report coming in ahead of expectations and even showing signs of faster hiring after adjustment for Census employment. Supporting that idea, the unemployment rate dropped sharply, which occurred despite the accelerating pandemic. Following the jobs data, consumer confidence has ticked up somewhat.

Looking at higher-frequency data, however, there are signs that consumer spending may be starting to soften. Overall, in the context of the rising medical risks, the data suggests that the consumer is still resilient, but cracks may be starting to show.

Source: https://tracktherecovery.org/

Business sector. On top of signs of improvement in the consumer economy, the business sector continues to do well. Business confidence and investment remain at pre-pandemic levels, and specific higher-frequency indicators are showing improvement in many cases.

The real question, going forward, is how durable this recovery is. Much of the data has continued to improve despite the ongoing third wave, suggesting substantial resilience, and there are signs that the economy is adapting to the pandemic. While there are indications that the positive trends may be weakening—and pending lockdowns in several states will be a headwind—given the resilience of the recovery in the face of the medical and stimulus headwinds, it is likely the recovery will be durable.

Given that durability in the face of risk, we should remember there are also opportunities. The biggest one at the moment is that with the passing of the election, another federal income support program has become more likely, which would help the economy ride out any weakness from the rising medical risks. In any event, while there are certainly headwinds, so far at least confidence and spending are still holding up, and the recovery is still moving forward despite some slowing.

The Markets: Rally on Reduced Risks

Markets continue to rally on the fact that a great deal of the election uncertainty has passed and the economic news continues to be positive. Markets are also responding to reduced policy risk, as expanded federal fiscal support for the economy now looks more likely.

Between the resilient economy and the potential for more federal stimulus, markets are largely ignoring the rising medical risks. With everything that is going on, that seems a reasonable reaction, but one that leaves open the possibility of more volatility ahead as medical risks move back into the headlines. We can reasonably expect the current positive trends to have some durability over the next couple of weeks, but the medical news could easily lead to more volatility during that time.

Volatility Ahead?

The news this week is that the election has now passed and the economy continues to grow, and markets are cheering those facts. At the same time, they continue to ignore the medical risks, which may be out of the headlines but are rising. The third wave continues, with medical risks rising, especially at the state levels. With the data so far showing no signs of peaking and with widening geographic spread in multiple states, the risks are now material at the national level. Note, however, that we have been through this before, and it is just a matter of time until we get the policy changes that can once more bring the pandemic under control. We saw the start of those changes last week, which will help going forward.

The economic risks are also real. Despite recent positive news, we do see some slowing in consumer spending. That said, growth has continued and has been much more resilient than expected. This is a positive signal for the future, and we have more upside risk here as well as more federal stimulus looks probable now the election is over. Finally, while markets are rallying on the reduced political and policy risks, as well as possible stimulus, more volatility is quite possible as the medical news moves back to the headlines.

Given all of this, over the next couple of weeks the most likely case appears to be further deterioration of the medical news as the third wave proceeds and continued slow improvement on the economic front. Markets will likely keep bouncing around on new developments, so expect more volatility. This will be a difficult period until we get the pandemic under control again—but get it under control we will. It will just take some time.

###

LifeTime Asset Management is located at 4700 Homewood Ct. Suite 340, Raleigh, NC 27609, and can be reached at 919-845-5315. Securities and Advisory Services offered through Commonwealth Financial Network, Member FINRA/SIPC, a Registered Investment Adviser. Fixed Insurance products and services offered through CES Insurance Agency.

Authored by Brad McMillan, CFA®, CAIA, MAI, managing principal, chief investment officer, and Sam Millette, senior investment research analyst, at Commonwealth Financial Network®.

© 2020 Commonwealth Financial Network®